Not satisfied with one-night stands, companies want long-term relationships with their customers — and they’re getting them, courtesy of subscription services. What started in media is swarming virtually all other consumer sectors, and opening opportunities for investors.

The subscription business model has pulled in one industry after another — everything from health care to transportation, and from razors to sneakers. Many observers say the trend found its footing with the pay-by-the-month model of Netflix (NFLX). Now even the theater chains that compete with the vaunted movie service are coming on board.

It’s all given rise to a “subscription economy.” Why spend the time to woo buyers over and over to capture one-time transactions when you could hook customers for good by switching to a subscription business? It could be just a matter of time before virtually all sectors embrace the philosophy, fans of the model say.

“This concept has really exploded in the last three to four years,” said Tien Tzuo, co-founder and chief executive of Zuora (ZUO). Zuora provides internet cloud-based software for companies to launch and manage their subscription business. “The power of these subscription services is a tighter relationship with the customer.”

Companies are getting weary of the unpredictable nature of transactional businesses, so they ask customers to sign up for subscription services. These annual or monthly payment plans provide companies with a predictable revenue stream and the potential for greater lifetime sales from each customer.

Tzuo popularized the term “subscription economy” to describe the trend’s wide-reaching impact. What makes modern subscription services different from those in the past — think magazines and newspapers — is the dynamic customer-centric relationship afforded by information technology and e-commerce.

Subscription Services: A 20-Year Trend

A subscription business provides a way for companies to lock in their best customers, says Eddie Yoon, a consultant and author of the book “Superconsumers.”

“All brands will try to offer subscriptions, but only a few will take,” he added. Consumers will push back if they feel overwhelmed with subscription services, Yoon says.

“People won’t tolerate a world where everything is subscriptionized,” he said. “For the things that you really care about, you’ll definitely subscribe.”

Subscription Health Care?

But in many sectors, the model is working. In the stodgy health care industry, the subscription service model is chipping away at thorny cost issues.

In recent years, more physicians have joined “direct primary care” services, such as MDVIP, which eliminate the health insurance middlemen. A subscription model can be more responsive to patients’ needs and provide predictable revenue streams for doctors.

Subscription medicine, also called membership or concierge medicine, requires patients to pay a monthly, quarterly or annual fee to access a wide range of benefits and services.

Benefits can include same- or next-day appointments and the ability to connect with doctors about health concerns via phone, email, video chat and other means.

This retainer-based medicine represents only a tiny fraction of primary care practices today, but it’s quickly catching on.

Razors And Sneakers

Some of the newest companies getting into the subscription business are consumer products firms, says Robbie Kellman Baxter, a consultant with Peninsula Strategies and author of “The Membership Economy.”

Some examples include Dollar Shave Club for razors and EasyKicks with Nike (NKE) for kids’ sneakers.

Dollar Shave Club, a unit of Unilever (UN), offers regular shipments of grooming products, such as razors and shaving cream, toothbrushes and toothpaste, or shampoo and soaps.

With EasyKicks, kids can get the latest pair of Nike and Converse shoes every two or three months. Plans start at $20 a month.

A subscription business gives consumer products firms a direct relationship with customers that they didn’t have before, Baxter says.

Investors Reward Subscription Services

More tech companies are joining Netflix by using the subscription business model. It has been a boon for desktop software companies like Adobe (ADBE), Autodesk (ADSK) and Microsoft (MSFT). They now offer internet cloud-based software for a monthly or annual fee. Microsoft’s Office 365 suite of software, for instance, starts at $59.99 a year for consumers.

Their sales are more stable and predictable now. Gone are the days of lumpy revenue associated with major software releases every year or so. Plus, investors give higher valuations to companies with a subscription business than those with transactional sales, analysts say.

Adobe stock has risen 770% from the start of 2012 through Tuesday’s close. Autodesk stock is up more than 360% in that time. And Microsoft stock has appreciated nearly 320%.

Many businesses that now use loyalty programs where customers build up rewards will try to switch to subscription plans instead, Yoon predicts.

In the future, entrepreneurs might offer subscriptions across brands or categories, he says. Amazon.com (AMZN) is on the forefront of bundling subscription services, including music, video and digital books in its Prime membership program.

Netflix Led The Subscription Economy

A number of companies, of course, are veterans of the subscription business. When Netflix began 20 years ago, it changed the value equation for consumers.

Netflix paired recurring monthly payments with a personalized entertainment service built on intimate knowledge of customers and their preferences. After starting with DVDs by mail, it eventually created the subscription video-on-demand sector, which it now dominates.

Its success spawned similar subscription services such as Spotify (SPOT) for music, GameFly for video games, Apple (AAPL)-owned Texture for digital magazines, Ancestry.com for genealogy and other businesses.

Eventually, dinner took the subscription route with home-delivered meal kits from firms like Blue Apron (APRN) and HelloFresh.

And instead of purchasing or leasing cars you can use a subscription service from the likes of Ford (F) and Volvo.

Dissecting Movie Subscription Services

Movie theaters have joined in. It all started with the likes of MoviePass, a subscription movie ticket service owned by Helios and Matheson Analytics. It offered a film per day for a meager $9.95 a month, but the business model proved unworkable, pushing the company near bankruptcy. It said Thursday that it’s planning to offer a three-tiered subscription plan ranging from $9.95 to $19.95 a month.

Still, movie chains followed. AMC Entertainment (AMC) recently began offering monthly passes for subscribers to see a certain number of movies for a set price.

AMC said Nov. 8 it has signed up 500,000 subscribers to its Stubs A-List subscription service. It launched the service June 26. For $19.95 a month, Stubs A-List subscribers can see up to three movies a week at AMC theaters.

On a conference call with analysts, AMC Chief Executive Adam Aron said the service will be profitable in 2019 — a year ahead of projections. He said the service is creating more loyal, frequent customers and stimulating concession sales.

Others are following suit, including from online service Sinemia and theater chain Cinemark.

Subscription Box Business: ‘Totally Faddish’

But while one subscription business may be a great idea, others are just following trends, such as the boom in subscription box offerings for clothes, cosmetics, food and other items.

“It is totally faddish right now,” Peninsula Strategies’ Baxter said. More than 5,000 subscription box offerings now clutter the U.S. “Most of them are going to fail.”

Among the bad use cases is a “tie-of-the-month club,” she told IBD. “How many ties does any dad need?”

Others aren’t a good value because they don’t have the economies of scale needed to secure discounts from suppliers. They end up charging their customers a premium.

This is one of the problems that has faced meal-kit service Blue Apron, she says. It lacked critical mass, so large competitors like Amazon and Walmart (WMT) were able to come in and eat its lunch. Blue Apron also focused more on customer acquisition than retention, she says.

Growth Challenges For Subscription Business

Subscription services can be difficult to scale, says Robert Skrob, a consultant with Membership Services and author of the book “Retention Point.”

“A lot of subscription businesses are caught in a trap where their customer acquisition costs are so high and their churn rate is so high that they can’t grow,” Skrob said.

Services can improve their odds of success by offering upsells beyond the initial subscription, he says. The best subscription business puts a lot of focus on community building to make members feel like they’re part of a movement.

He points to the seasonal subscription box service FabFitFun. Its boxes come with a lively insert detailing the product selections and profiling members of the community.

“FabFitFun does a very good job of building a community and a movement around health and female empowerment that transcends the box,” Skrob said.

Zuora Saw An Industry Opportunity

Zuora formed in 2007 to address the specific needs of those venturing into a subscription business model for software to run their operations.

Business management software available at the time from Oracle (ORCL) and SAP (SAP) was focused on the product economy, the company’s Tzuo says. Their systems tracked inventory, warehousing, logistics, supply chain management, bill of materials and other product data.

Subscription businesses have different needs. They want systems for tracking customer usage, behavior and churn and for automating billing and finance operations.

Businesses have embraced the subscription model because it’s what customers are gravitating toward. They like the perceived value and hassle-free nature of subscription services. Plus, companies must work hard to keep your business under the subscription model, Tzuo says.

“It’s not like a gym membership where they hope you actually don’t go,” he said. Modern subscription businesses “want you to use the service. They’re fighting for your time and attention and providing value for you.”

CrossFit Breaks The Gym Membership Mold

A successful subscription business has active, loyal customers, Baxter says.

Take CrossFit, the intense workout franchise. It has turned the set-it-and-forget-it concept of gym memberships on its head. CrossFit members work out three times a week with the same group of people, which engenders support and camaraderie by encouraging participation.

“They’ve created a real membership model around results and community and it’s been super fast-growing and effective,” she said. “They do everything they can to make sure that you get value for your membership.”

The latest companies to adopt the subscription business model are those selling internet-connected devices, Baxter says. That includes everything from Peloton indoor exercise bikes with video training sessions to home security cameras from Arlo (ARLO) and Alphabet’s (GOOGL) Nest with intelligent alerts.

Apple Joins The Subscription Economy

Consumer electronics giant Apple has been touting subscriptions as part of its greater emphasis on services.

Apple’s services business hit $10 billion in revenue in the September quarter. The business grew 27% year over year and accounted for about 16% of the company’s total sales.

Paid subscriptions through its App Store reached over 330 million last quarter. That’s up 50% year over year and includes both Apple and third-party services like Netflix.

Apple’s App Store offers 30,000 third-party subscription apps. The largest of them represents less than 0.3% of Apple’s total service revenue.

Subscription Services Undermine Ownership Model

One of the casualties of the subscription business model for some categories is the notion of ownership.

Where consumers once owned their music collections, they now pay to access all the songs they want. They come from on-demand streaming services like Spotify or Apple Music.

Or consider desktop software from companies like Adobe and Microsoft. They’ve moved from selling customers occasional software products to providing software-as-a-service. By offering software as an internet cloud-based application, they’re able to provide extras such as frequent updates and online storage.

Even computing hardware is being offered as a service. Apple customers can get a new iPhone every year with AppleCare coverage by subscribing to the iPhone Upgrade Program.

Ride-hailing services Uber and Lyft play into the trend as well. Many consumers now, especially in major cities, would rather order transportation from a smartphone app. It’s better than owning a car and all the costs and hassles associated with it. Uber and Lyft are experimenting with subscription plans for frequent customers.

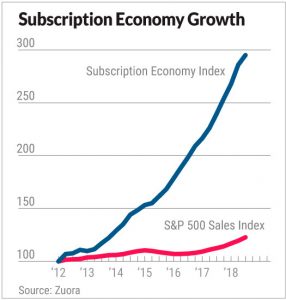

Subscription Economy Index Tracks Growth

Zuora has created the Subscription Economy Index to measure the performance of a subscription-based business. It releases the results twice a year following the second and fourth quarters.

The index reflects the growth metrics of hundreds of companies worldwide. It spans such industries as software-as-a-service, media, telecommunications, corporate services and Internet of Things.

According to the most recent report, released Sept. 19, overall subscription businesses have grown revenue about five times faster than S&P 500 company revenues and U.S. retail sales over the past six and a half years.

Subscription businesses grew revenue at an average annual rate of 18.1% from Jan. 1, 2012, through June 30 this year. That compares to 3.3% for the S&P 500 and 4.1% for U.S. retail.

Source: Investor Business Daily